An Imperfect Storm for UK Businesses looking to Hire

What’s happening in the UK’s Accountancy & Finance Job Market currently?

It’s tight at the top…

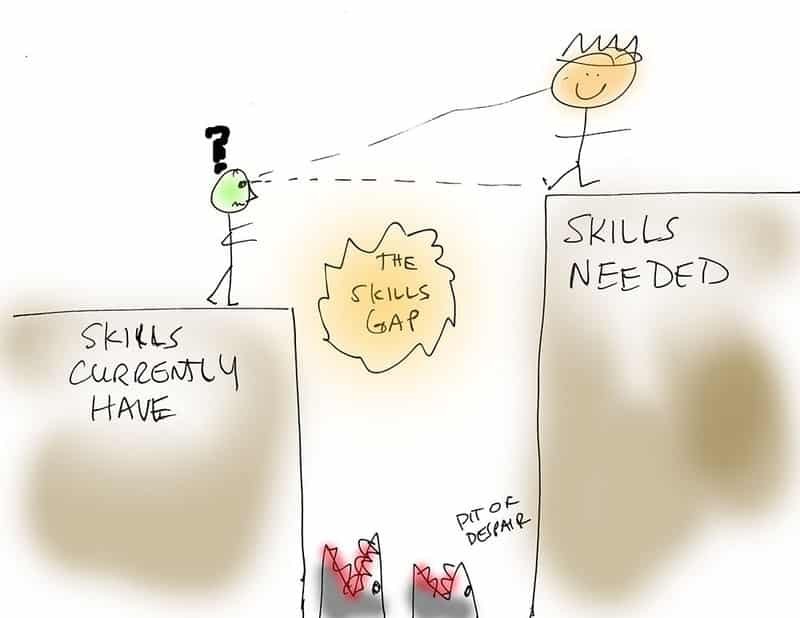

The market seems to be heading for a perfect (or imperfect depending on your side of the recruitment fence) storm; there is a definite skill / talent gap which appears to be set to widen futher.

The economy has seemingly remained robust and vacancy numbers (although reportedly easing slightly) continue to be high.

Whilst employment took a significant dip recently overall UK unemployment rate is still close to its lowest level for 44 years.

Wage growth has also continued to far outperform inflation and salaries are rising across all areas of the finance function. Even if the accountancy and finance job market softens there is still a major gap between requirements and skill availability and in my opinion it would take a major fall in vacancies to fill the void.

- Sat behind the fairly robust job market in the sector is a growing reticence among ‘passive job seekers’ to commit to moving to greener grass. ‘Candidate’ confidence seems to be ebbing. Some of those tentatively considering a new challenge are stepping back into the shadows whilst Brexit plays itself out.

The result is continued fierce competition for the strongest candidates.

What can you do:

- Move decisively through your recruitment processes. As with all tightening competition fine margins play a part.

You won’t want to rush but make each individual candidate’s journey as smooth as possible.

CV to interview, interview to 2nd stage, 2nd stage to decision, decision to contract out. Treat each candidate individually – if someone feels they are being benchmarked and a process starts to drag out they will have other options and the momentum of the process can play a part in their engagement with the business / opportunity you are offering.

2. Don’t recruit. Play a waiting game. This might be an odd suggestion but when the market is this ruthlessly competitive you have 2 choices – go hard or go home. Floating a job spec out and playing a waiting game while your current team peddle harder under the proviso that you will recruit when the right candidate arrives is a dangerous choice. If your role is seen to be ‘kicking around’ in the market it will be viewed with potential caution and loses its appeal in the local candidate pool. If your budget doesn’t meet the market requirement to hire the person you want then something should give (taking a less experienced hire, foregoing some of your ‘must haves’ or throw more money at it). Sitting and waiting for perfect is likely to leave you doing just that.

3. Wrap your arms, legs, ears and development plans around your talented finance people. If you are experiencing challenges in recruitment across finance then you can be somewhat reassured that your competitors are sat in the bottom of a similarly wet and leaky boat. Those that are organized will be proactively targeting your current talent. It is key that you are tapping into the drivers and motivations of your existing squad and doing all you can to retain your best people. As with most things (other than maybe a hangover) prevention is definitely better than cure.

4. Look internally – do you have a better hand that you might feel at first glance. Maybe there are other companies in your group that may have someone who solves your challenges. Maybe you have someone highly ambitious who would relish the chance to be stretched into a new role.

5. There is merit in interim (it’s no coincidence that they are anagrams). If you have a vacant role and the market is too sticky, then interim professionals can play a major part in your strategy. Generally speaking, going more heavyweight than less will save time, energy and usually money in the long run. As per point 1 – in this instance if you see someone you rate then be hasty – get them in.

6. Lastly everyone wants to be a business partner…. This trend has been growing over recent years but more than ever qualified accountants are turning away from ‘financial accounting and reporting’ in favour of roles with high levels of business partnering, operational and commercial exposure. he result ultimately is challenging for FDs and FCs… their current financial accountant may be seeking a step into what they perceive to be a more commercial business-facing role…. The candidates in the market are reluctant to apply for what are considered to be ‘drier’ reporting or technical accounting remits. If you have a vacancy then having very little commercial involvement, project exposure or business interaction makes it very tough to fill. Shaping the role and sharing some duties might help solve the puzzle.

info@thearg.co.uk